Ad

Effect of RUSSIA-UKRAINE WAR on India from different Aspects

356 views

Follow Us:

356 views

As Russia declared war against Ukraine, the impact of the same could be seen on the markets.

IMPACT ON RUSSIAN MARKET

The Moscow stock exchange on Thursday suspended operations after Russian President Vladimir Putin declared war against Ukraine. The exchange did not announce any time frame for resumption of operations.

The operations on the Moscow stock exchange or Moex were halted indefinitely following a 14.2% drop since Monday, the biggest single day fall since 2014.

Ruble, the official currency of the Russian Federation, fell by 3.5% after Russia's invasion of Ukraine. Meanwhile, Asian currencies and stocks were battered on Thursday with shares in Singapore and India losing about 3% as Russian attacks on Ukraine spoiled investors' appetite for risk.

International crude oil breached $100 a barrel for the first time since 2014, making palm a more attractive option as biodiesel feedstock.

IMPACT ON INDIAN MARKET

The share market plunged more than 3% in early morning trade on Thursday, as investors fled risk assets after Russian President Vladimir Putin declared war against Ukraine.

The blue-chip NSE Nifty 50 index was down 3.24% or 552.95 points at 16,510.30 and the S&P BSE Sensex was 3.28% or 1,874.56 points lower at 55,357.50. Both indexes opened more than 3% lower and were headed for their longest losing run since March 2020, down for a seventh straight session.

Explosions rocked the breakaway eastern Ukrainian city of Donetsk after Russian President Vladimir Putin authorized a military operation on Thursday in what could be the start of war in Europe over Russia's demands for an end to NATO's eastward expansion, according to a report.

In Mumbai, the Nifty Realty index .NIFTY REAL and the Nifty public sector bank index .NIFTY PSU were the top losers, losing more than 3% each.

As Ukraine and Russia start the war, prices of essential commodities are likely to rise in India.

Tremors of the Russia-Ukraine crisis are likely to be felt by the aam aadmi in India as costs of essential commodities are set to rise. While tensions between Russia and Ukraine increase, the global economy is on tenterhooks. From natural gas to wheat, experts believe that prices of multiple commodities will increase in the near future.

On Thursday, Russian President Vladimir Putin ordered an invasion of Ukraine. He said that it was aimed at 'demilitarization' of Ukraine and added that Moscow does not plan to occupy Ukraine.

Here’s what is likely to be impacted in the days to come:

PRICE OF NATURAL GAS TO RISE

The Ukraine-Russia crisis has pushed Brent crude oil price to $96.7 per barrel, the highest it has been since September 2014.

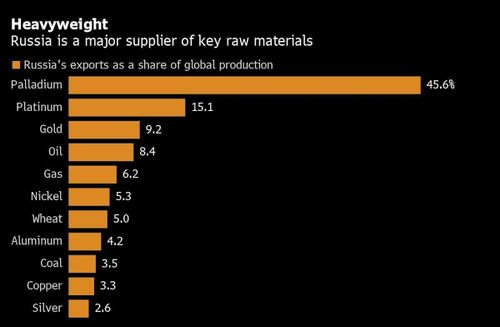

Russia is one of the biggest producers of crude oil. The current crisis can lead to prices shooting up to more than $100 per barrel in the days to come. An increase in crude oil price will have a spillover impact on global GDP.

Analysis by JP Morgan notes that a spike in oil prices to $150 a barrel would reduce global GDP growth to just 0.9%. Crude oil-related products have a direct share of over 9% in the Wholesale Price Index (WPI) basket. An increase in Brent crude prices, hence, will increase India's WPI inflation by around 0.9%.

According to experts, the price of domestic natural gas (CNG, PNG, electricity) could increase tenfold now the war has started.

LPG, KEROSENE SUBSIDY WILL INCREASE

The rise in crude oil prices is expected to increase the subsidy on LPG and kerosene.

PETROL, DIESEL PRICES WILL RISE

In the past, high crude oil prices have contributed to the increase in petrol and diesel prices across the country. India witnessed record highs in terms of fuel prices in 2021.

If the Russia-Ukraine crisis continues to simmer, India could see an increase in petrol-diesel prices.

Oil consists of about 25% of India’s total imports. India imports more than 80% of its oil requirement. A rise in oil prices will impact the current account deficit.

FOOD (WHEAT) PRICES WILL RISE

If there is an interruption in the flow of grain from the Black Sea region, experts fear it could have a major effect on prices and fuel food inflation.

Russia is the world's top wheat exporter while Ukraine is the fourth largest exporter of wheat. The two nations account for nearly a quarter of total worldwide exports of wheat.

According to a recent United Nations report, food prices have already climbed to their highest level in more than a decade largely because of the impact of the pandemic on food supply chains.

The days to come could see volatility spikes in energy and food prices. The resultant investor sentiment could threaten investment and growth in economies around the world.

PRICE OF METALS WILL RISE

The price of palladium, a metal used in automotive exhaust systems and mobile phones, has soared in recent weeks amid fears of sanctions being imposed on Russia. The country is the world’s largest exporter of palladium.

Latest News

Reviews & Guides

View All

Vivo V70 Elite Review 2026: Price in India, Specs, Features

Asus Zenbook 14 UM3406G Review: All New Thin and Light Ai Laptop

Nothing Phone 3a Community Edition First Impressions: A Fresh Take on Budget Smartphones

Realme P4 Power 5G First Impressions: Massive Battery and Power

Samsung Galaxy S26 Ultra Privacy Display Explained: How It Works

Apple iPhone 17 vs Samsung Galaxy S26: Price in India, Specifications

Should You Buy a Smart AC in India 2026? Pros, Cons, and Top Models

Window AC or Split AC: What Should You Choose in 2026?